Blog

Good, Better, or Best: Preferred Equity or Common Equity?

The simple truth is that there’s no clear answer to this question because it depends on you as an investor. Both equity investments have their own equally important place in the minds of real estate investors, sponsors, and lenders. For our discussion, we will focus on the investors. Diversify

Multifamily Outlook

MULTIFAMILY OUTLOOK Investors/Experts Expect Multifamily To Outperform Despite the slew of headwinds facing the broader real estate industry, investors, economists, and real estate experts maintain a positive outlook on the years ahead, especially for the multifamily asset class. The prospect of falling inflation and interest rate stability, paired with

Elevating Your Multifamily Portfolio

The Top 10 Most Sought-After Amenities in Commercial Real Estate In the real estate industry, more than simply having a prime location and stunning design is needed to attract and retain premium tenants. The added amenities truly enhance residents’ lifestyles and set properties apart. As sponsors, we understand this

Innovation & Efficiency

Artificial Intelligence in Real Estate | Innovation & Efficiency Real estate investment has historically been an industry left relatively unchanged by technological environments. However, the waves produced by the groundbreaking uses being discovered in generative artificial intelligence and their applications in real estate will soon become more apparent. From

The Cost of Doing Nothing

A SIMPLE SOLUTION TO A COMPLEX QUESTION While our government currently reports an annual inflation rate of 5% for 2023, price increases feel closer to 15% or more. Almost everything I touch in my day-to-day life has more than a 5% price increase. No one can predict the future,

Courage And Capital

Every year we reflect on our performance as a company and what value we provide our investor community. Through this process, we leverage our resources and 30-plus years of experience to provide better service and opportunities to our employees and investors. It is with little surprise that 2023 has

Have No Fear Real Estate Is Here

RESPECT THE HEADLINES, DO NOT FEAR THEM The negative headlines are increasing, and we are likely to encounter economic headwinds or outright recession in the near future, (if we’re not already there.) If you’ve never been through a recession, it can be scary, particularly if you’re not prepared. Things

Don’t Let Economic Changes Get You Down

TURN THE ECONOMY TO YOUR ADVANTAGE Inflation and the rise in interest rates are causing pain for many people. Some are wondering what they should do next, and some feel a little paralyzed and are doing nothing. For those who entered the investing and real estate world after 2008,

Why Inflation Has Investors Turning To Multifamily Real Estate

WHY INFLATION HAS INVESTORS TURNING TO MULTIFAMILY REAL ESTATE INVEST IN INFLATION. IT’S THE ONLY THING GOING UP. ~WILL ROGERS How true this quote is when you consider that Real Estate is one asset class that benefits from inflation. As we manage through both domestic and world events, history

Uncle Ed’s Cash Machine

COMMERCIAL REAL ESTATE VALUE The other day, I received a call from a new investor we will call Bob. Bob was very excited to be an accredited investor at a reasonably young age and he was ready to learn. Rarely do I get a call that someone wants to

SEC Loosens Accredited Investor Status

SEC LOOSENS THE REINS ON ACCREDITED INVESTOR STATUS On August 26, 2020, the SEC loosened the restrictions a little regarding the definition of an accredited investor. Why is that important to you? In the past, many private investment firms required you to be an accredited investor to participate in

Cash or Trash

CASH OR TRASH I was recently at a conference in the mountains and there was a lively debate about the utility of cash in these uncertain times. The title of the debate was aptly named “Cash or Trash?” Four very bright individuals debated both sides of the equation. In

How Long Is Your Runway?

HOW LONG IS YOUR RUNWAY? If there is anything I have learned over my experiences since the first oil crisis in the late ’70s (gas rationing to a 16-year-old was the end of the world) through the credit crisis of 2008 and all the other crises in between, it

Preferred Equity vs Common Equity

WHAT IS PREFERRED EQUITY? John F. Kennedy once said, “Change is the law of life, and those who look only to the past and present are certain to miss the future.” At Presario, we always try to keep our eyes on the horizon to keep your investment safe and

Got Good Debt?

Why Presario Ventures utilizes 221 (d)(4) HUD-insured construction loans for Multifamily. GOOD DEBT? Housing and Urban Development, (HUD) insured loans are not for everyone, but can be the perfect structure for the right multifamily investment. There can be bad debt, good debt, and really good debt. First, let’s define

What are you Falling Back on in your Golden Years?

The city of Austin just allocated $500,000 to “understand” why people are dumping electric scooters in Lake Austin. I would have done it for $250,000 and told them it’s because they were inebriated and are not respectful of other peoples’ property. The point here is if the government is

Let’s Face It

Let’s face it, we are real estate guys at Presario. We live and breathe it every day. But we are also investors. Is there a difference? Sometimes yes and sometimes no. Often the two overlap and sometimes they diverge. These days real estate investing is a hot commodity. Today

Multifamily Rents Continue Positive Momentum

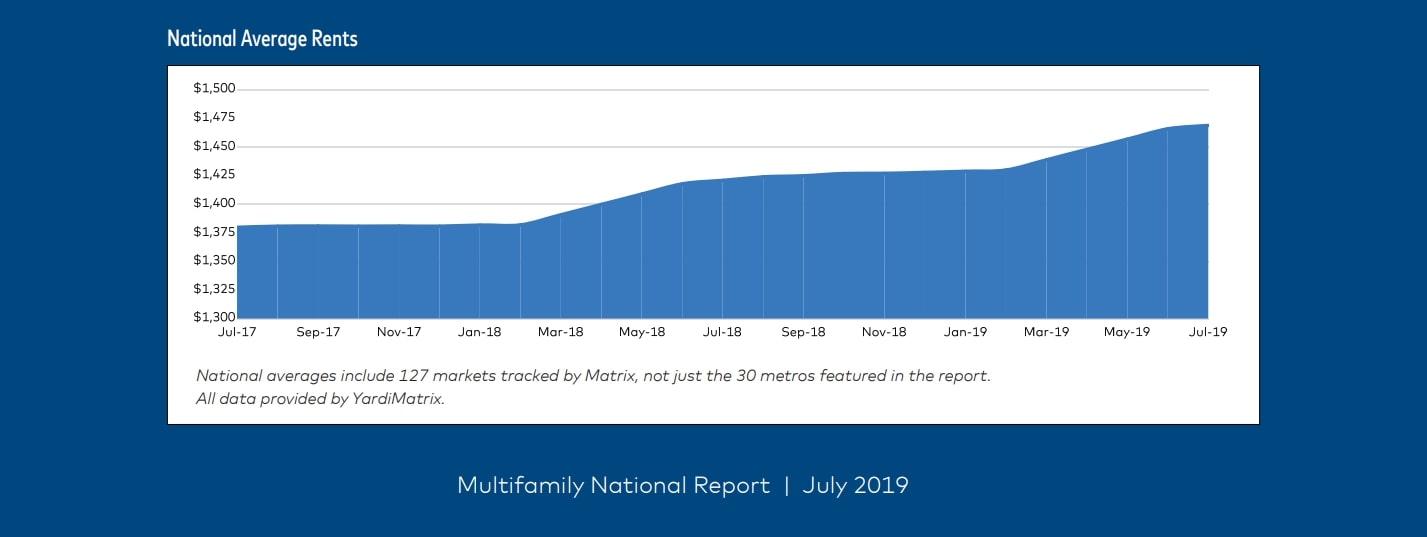

MULTIFAMILY RENT GROWTH REMAINS A GOOD BET ■ The average U.S. multifamily rent increased by $3 in July to $1,469. Year-over-year growth increased to 3.4%, up 10 basis points from June. Rent growth has remained at the 3.0% level or higher all year. ■ In this prolonged positive cycle

Travel for the Mind & Soul

The Dalai Lama once said, “Once a year, go someplace you’ve never been before.” If you ponder that statement, you could come up with two meanings. Certainly, wanderlust and travel come to mind. There is nothing better than exploring new parts of the world and embracing different people and

FED Loosens Policy – Opportunities for Investing in Multifamily Real Estate

Through the last quarter of 2018, the Federal Reserve increased interest rates by 25 basis points; pushing it to the highest rates recorded since 2008. The ripple effect of this activity was felt across the real estate industry. Inflation coupled with higher interest rates resulted in a significant decrease

Commercial Real Estate Should Be In Your Portfolio

A recent NAR report, commercial real estate investments in the US topped $152.7 billion in 2018, a 17% increase from 2017. The stats reveal that commercial real estate has been an attractive investment, even during market fluctuations. The NCREIF index shows the average annual returns of 8.8% from Commercial

Five Ways A Busy Professional Can Use Leverage To Become A Real Estate Investor

We live in a world of specialization. There are legal, medical, engineering and many other specialists. These experts spend a significant amount of time and intense study to become well-versed in their fields. This sometimes creates a blind spot when it comes to investing for retirement. That blind spot

Interest Rates, Yields, and the Future for Multifamily Investors

There is no surprise that some of the top questions we get today are “how will rising interest rates impact my investment in multifamily” and should we get out of real estate before “what”? The answer nobody really wants to hear is, “it depends”. Now let’s dissect the general

Is Passive Income Really Passive?

Passive income is great at almost any level, but true passive income still needs your continuous education and attention to manage it. Today I see people preparing to retire with pensions, investments, or mutual fund dividends that they know little about. I do not know anyone who wants to

Should I Be In the Market or Out of the Market?

Should I be in the market or out of the market? This is a question I hear from investors every week. Why? Markets and assets tend to go up over time. Not in 12, 24, or 36 months, but over 10, 20, or 30 years. If you employ a

Good, Better, Best – Discussing Debt at our Latest Education Series Event

Now that fall is here we’re pleased to bring back our Good, Better, Best Education series. We recently hosted a well-attended event at our office with Cheryl Higley, a lender with Berkeley Point Capital. Berkeley Point Capital offers a full complement of Fannie Mae, Freddie Mac, FHA, Life Company,

Updated: Real Estate Investment Builds Passive Income for Physicians

Our goal at Presario Ventures is to be wealth makers for our investors. One of the ways we can help them grow their portfolios is by providing education that will give them some of the tools they will need to make sound decisions. We regularly host Doctor Dinner events designed

Talking Passive Income with Physicians

The Presario Ventures team recently traveled to the Florida Medical Association annual meeting in Orlando, where we were pleased to talk with physicians who are interested in creating passive income investments through real estate. Presario Co-Founder Tom Burns, an orthopedic surgeon, knows first-hand the kind of financial dilemma physicians

Metrics to Consider When Investing in Commercial Real Estate

What metrics are important in commercial real estate investing and what is important when considering a Return on Investment? Maybe a better question is how much money you can expect to yield on that investment if the following metrics were presented to you for an investment opportunity. Which one

The Growing Role of Amenities in Multifamily Real Estate

The old adage “location, location, location” might soon be replaced in the multifamily real estate market with “amenities, amenities, amenities.” Amenities, from appliances to community centers, are playing an increasingly large role in multifamily buildings. Residents in primary and submarkets expect more amenities, and properties with the most in-demand

Should I Be In the Market or Out of the Market?

Should I be in the market or out of the market? This is a question I hear from investors every week. Why? Markets and assets tend to go up over time. Not in 12, 24, or 36 months, but over 10, 20, or 30 years. If you employ a conservative defensive strategy when...

Good, Better, Best – Discussing Debt at our Latest Education Series Event

Now that fall is here we’re pleased to bring back our Good, Better, Best Education series. We recently hosted a well-attended event at our office with Cheryl Higley, a lender with Berkeley Point Capital. Berkeley Point Capital offers a full complement of Fannie Mae,...

Updated: Real Estate Investment Builds Passive Income for Physicians

Our goal at Presario Ventures is to be wealth makers for our investors. One of the ways we can help them grow their portfolios is by providing education that will give them some of the tools they will need to make sound decisions. We regularly host Doctor Dinner...

Talking Passive Income with Physicians

The Presario Ventures team recently traveled to the Florida Medical Association annual meeting in Orlando, where we were pleased to talk with physicians who are interested in creating passive income investments through real estate. Presario Co-Founder Tom Burns, an...

Metrics to Consider When Investing in Commercial Real Estate

What metrics are important in commercial real estate investing and what is important when considering a Return on Investment? Maybe a better question is how much money you can expect to yield on that investment if the following metrics were presented to you for an...

The Growing Role of Amenities in Multifamily Real Estate

The old adage “location, location, location” might soon be replaced in the multifamily real estate market with “amenities, amenities, amenities.” Amenities, from appliances to community centers, are playing an increasingly large role in multifamily buildings....

Helping You Get What You Want

I recently completed a two-day sales seminar created by my friend Russell Gray of the Real Estate Guys Radio Show. Why would a real estate operator, investment manager, and physician attend a sales conference? Because sales, when done right, is so much more than...

Why Investors See Austin and San Antonio as Attractive Multifamily Markets

It’s no secret that Central Texas is an attractive market for many things – for the high-tech industry, for entrepreneurs, for healthcare, and of course for private real estate investment. Over the past few years, Austin and San Antonio have topped many lists...

Tax Advantages to Multifamily Real Estate Investment

Real estate investments are a great way to grow wealth. And knowing the advantages of different types of real estate investments means you can get the best possible return. When it comes to residential real estate investment, many investors may be tempted to steer...

How HUD Projects Are Good for Investors

One of the more frequent questions we hear from our friends and investors is why Presario seeks out multifamily development projects and acquisitions insured by HUD (Housing and Urban Development). It’s a good question, and here we take a closer look at why HUD...

From Medicine to Millions

Presario Ventures recently attended the Texas Medical Association’s TexMed 2018 annual meeting, where the team had a chance to talk to medical professionals about creating a passive income stream with passive real estate investing.. Presario Co-Founder Tom Burns, an...

Commercial Real Estate Cost Segregation Can Improve Your Cash Flow

Cost Segregation is the practice of identifying assets and their costs, and classifying those assets for federal tax purposes. In a real estate cost segregation study, certain commercial building costs previously classified with a 39-year depreciable life, can...