The No Regrets Investor

More than a system, it’s a mindset.

Become a No Regrets Investor to leverage the knowledge and systems my team and I use to consistently increase portfolio value for our investors and create more Financial Certainty for YOU and YOUR FAMILY.

Breaking the Cycle

In 2001, I ventured into the world of real estate, inspired by the childhood promise I made to myself: that my wife and I would create a better future for our family. Was it easy? Hell no. Has it been worth it? Hell yes. Although my wife is no longer with us, I’ve remained committed to the promise with my children. After 20 years, this led me to the development of a Peer-to-Peer No Regrets Investing Group. This is our version of 20 years of experience that granted us financial and emotional stamina during the most challenging moments of our lives.

Today, I want to help families grow a real estate portfolio that can be foundational and persevere when markets turn soft. For our investors, we have created a peer-to-peer mentoring group. If you are committed to making fundamental changes, we invite you to contact us and join a select group of like-minded investors. The goal: continue to provide ideas, strategies, and opportunities for your financial growth with long-term, highly vetted investment opportunities that prove to be lucrative and sustainable.

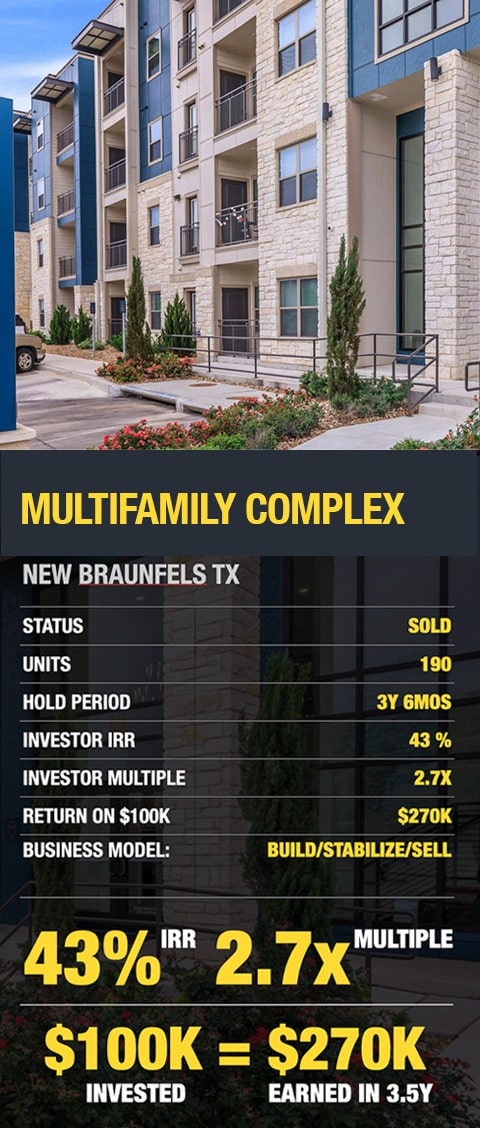

The No Regrets Investment Group | Typical Project Samples

What We Achieve With Our Investors

Current Focus: Investment in class a Multifamily assets

Geographic Focus: Texas

Investment Type: Preferred Equity

Distribution: Before common equity, after senior debt

Investment Period: 2-4 Years

Total Return: 10% per annum

How is preferred equity used in real estate?

Preferred Equity is often used in real estate projects to bridge the gap between equity and debt financing. It can be attractive to investors who want some degree of ownership while seeking more predictable returns and protection in case the project encounters financial difficulties.

Preferred Equity Investor Benefits

Priority Position Over Common Equity

Ensuring Your Returns Before Common

Fixed Returns & Steady Income

Predictable Returns, Reliable Source of Income

Shorter Holding Period

Potential For Quicker Liquidity

Less Volatile

Diversify Your Portfolio

hard asset – inflation hedge

Investor Evolution

Investments and investors are always evolving, yet they stay the same. When you consider the principles of real estate, very little changes; however, strategies, technology, and consumer preferences are constantly changing. Commercial real estate remains a resilient cornerstone of investment portfolios, poised to thrive amidst evolving market dynamics. Change is constant, so be prepared to shift your investment strategies to protect your portfolio.

“Currently, market conditions are shifting for investor strategies. There is a reset in the industry, and opportunities for investors are different than in the past decade. Understanding that today, we live in a more realistic investor environment, there is still high value and growth for investors when you know where to look.”

Our Proven Investment Methodology

For generating foundational wealth through real estate

Debt Structure

Terms

Recourse vs. Non-Recourse

Rates & Costs

Exit Strategies

Demographics

Age & Gender

Income & Education

Social Economics

Renter-buyer Profiles

Deal Structure

Waterfall Distributions

Debt & Equity Terms

Business Plan(s)

Demand & Supply

Infrastructure

Diversification

Migration Forecasts

Drivers

Investor First

Investor Returns

Capital Preservation

Relationships

“We are passionate about real estate because it is one investment sector that can positively change people’s lives for decades. We share with our investors our extensive knowledge so they can grow their portfolios and create a legacy.”

Learn More

Download Your FREE Bonuses

Download your free No Regrets Investor Resources and Tools to learn more about our investment approach, which includes:

- The No Regrets Investor Masterclass

A deep dive into investments that have thrived through 3 decades and 3 economic downturns - The No Regrets Investing System Real Estate Investors AI Playbook

In today’s tech-driven age, this playbook offers insights into leveraging AI, helping you pinpoint the best real estate deals

Free Bonuses

Making money is transactional.

Building wealth is foundational.

We believe people who invest in the next 24-36 months will do very well in the next 5-10 years.

Big wealth starts now.

Super discounts on Class A products.

20+ years in successful real estate investing have enabled us to control the three key areas needed to navigate challenging market conditions:

- Significant Market Knowledge

- Debt & Equity Sources

- Uncompromising Due Diligence Procedures

We are ideally positioned to take advantage of distressed opportunities through preferred equity offers while offering robust risk management for our investors.

Over the past two decades, we have built strong industry relationships and a network of proven professionals who regularly collaborate with us, confirming our investment premises.

The 5 Pillars of our Successful Track Record

We will share the lessons we have learned over the past 20 years. When we can arm you with knowledge, strategies, and investment structures, you will then have the confidence to execute.

How We Work Together

Current Opportunities

Where we are heading

The Syndicated Experience

$1.5 Trillion will be due in the next 5 years on multifamily construction loans will little optimism for vital refinance from banks. This will result in numerous quality real estate development projects needing rapid rescue capital to reach completion.

This is great news for us! Through our current pool of investors, we can capitalize on the best-distressed opportunities that are presented to us every month, sometimes daily.

If the current tempo is sustained, we can only expect an ever-growing pipeline of quality distressed products to pick from. There is simply so much product coming to market in the next 3 years, and this is the ideal time to hedge against inflation and lay the foundation for sustained income and long-term wealth.

Where are we investing today?

We are going for safe, conservative and income-generating plays to mitigate the downside inherent to uncertain economic times.

We are looking for preferred equity investors to join our current group who understand that some of the best opportunities exist in the dark.

We’ve been through this 3 times and we know where to go to find these opportunities. With our industry network, we get regular calls to provide equity and are currently moving on 3-5 transactions that meet our 3Y investment criteria.

Preferred Equity Highlights

Preferred shares, compared to common ones, offer priority for dividends, often with monthly or quarterly payouts. They include adjustable-rate shares with variable yields influenced by specific factors and participating shares, which can pay extra dividends tied to common stock profits. Preferred stock represents a hybrid of debt and equity, featuring fixed dividends and potential price appreciation, making it an attractive option for investors seeking stable future cash flows.

The No Regrets

Investing System Experience Syndication

Here’s what’s included in The No Regrets Investing Experience Syndication Package:

Deals, Mentoring, and Experiences

3-5+ Deals Per Year

AI-Enhanced Market Analysis, Real Estate Investment Identification and Management Tools

Live In-Person Experiences Annually

“Ask Me Anything” Mentorship Sessions

Optional In-Person Meetups

Access to my 30-year Database

Important note: Limited access to keep the experience highly personalized and engaging, NOT for everyone. Application required to ensure a great fit

Blog

Good, Better, or Best: Preferred Equity or Common Equity?

The simple truth is that there’s no clear answer to this question because it depends on you as an investor. Both equity investments have their own equally important place in the minds of real estate investors, sponsors, and lenders. For our discussion, we will focus on the investors. Diversify

Multifamily Outlook

MULTIFAMILY OUTLOOK Investors/Experts Expect Multifamily To Outperform Despite the slew of headwinds facing the broader real estate industry, investors, economists, and real estate experts maintain a positive outlook on the years ahead, especially for the multifamily asset class. The prospect of falling inflation and interest rate stability, paired with

Elevating Your Multifamily Portfolio

The Top 10 Most Sought-After Amenities in Commercial Real Estate In the real estate industry, more than simply having a prime location and stunning design is needed to attract and retain premium tenants. The added amenities truly enhance residents’ lifestyles and set properties apart. As sponsors, we understand this

Innovation & Efficiency

Artificial Intelligence in Real Estate | Innovation & Efficiency Real estate investment has historically been an industry left relatively unchanged by technological environments. However, the waves produced by the groundbreaking uses being discovered in generative artificial intelligence and their applications in real estate will soon become more apparent. From

The Cost of Doing Nothing

A SIMPLE SOLUTION TO A COMPLEX QUESTION While our government currently reports an annual inflation rate of 5% for 2023, price increases feel closer to 15% or more. Almost everything I touch in my day-to-day life has more than a 5% price increase. No one can predict the future,

Courage And Capital

Every year we reflect on our performance as a company and what value we provide our investor community. Through this process, we leverage our resources and 30-plus years of experience to provide better service and opportunities to our employees and investors. It is with little surprise that 2023 has

Have No Fear Real Estate Is Here

RESPECT THE HEADLINES, DO NOT FEAR THEM The negative headlines are increasing, and we are likely to encounter economic headwinds or outright recession in the near future, (if we’re not already there.) If you’ve never been through a recession, it can be scary, particularly if you’re not prepared. Things

Don’t Let Economic Changes Get You Down

TURN THE ECONOMY TO YOUR ADVANTAGE Inflation and the rise in interest rates are causing pain for many people. Some are wondering what they should do next, and some feel a little paralyzed and are doing nothing. For those who entered the investing and real estate world after 2008,

Why Inflation Has Investors Turning To Multifamily Real Estate

WHY INFLATION HAS INVESTORS TURNING TO MULTIFAMILY REAL ESTATE INVEST IN INFLATION. IT’S THE ONLY THING GOING UP. ~WILL ROGERS How true this quote is when you consider that Real Estate is one asset class that benefits from inflation. As we manage through both domestic and world events, history

Uncle Ed’s Cash Machine

COMMERCIAL REAL ESTATE VALUE The other day, I received a call from a new investor we will call Bob. Bob was very excited to be an accredited investor at a reasonably young age and he was ready to learn. Rarely do I get a call that someone wants to